- Home

- News Releases

- Back Issues

- April FY2023

- “Study Group on Ideal Approaches to the Distribution Industry Facing High Prices” Compiles Report, “Reviving Physical Stores,” to Redefine Ideal Approaches to the Distribution Industry Facing the Highest Prices in Forty Years

“Study Group on Ideal Approaches to the Distribution Industry Facing High Prices” Compiles Report, “Reviving Physical Stores,” to Redefine Ideal Approaches to the Distribution Industry Facing the Highest Prices in Forty Years

April 5, 2023

The current situation surrounding the highest prices in 40 years places pressure on the profit structure of the distribution industry, which is now facing the problem of labor shortages. Against this backdrop, the Ministry of Economy, Trade and Industry (METI) launched a “Study Group on Ideal Approaches to the Distribution Industry Facing High Prices” in July 2022 to hold discussions on future directions of efforts that the industry should make and held seven meetings for this purpose. Taking this opportunity, METI held a SUPER-DX Contest, as an event to cultivate promising IT companies in the industry, such as startups with excellent digital technologies.

Aiming to encourage the industry to sustainably fulfill its function, i.e., distribution of consumer goods, including the day-to-day necessities that are essential to people’s lives and local economies, METI has released a report as a compilation of the results of past discussions by the study group and also a collection of 22 case examples to present solutions to problems for the industry, which were recognized in the SUPER-DX Contest, an event aiming to facilitate the introduction of DX (digital transformation) by supermarkets, convenience stores and other retail stores.

1. Background

The distribution industry (wholesale and retail sale) is a major industry in the Japanese economy, accounting for 14% of its GDP and 16% of its working population, and it has contributed to Japan as an infrastructure supporting the day-to-day lives of people in communities even during the turmoil of the COVID-19 pandemic.

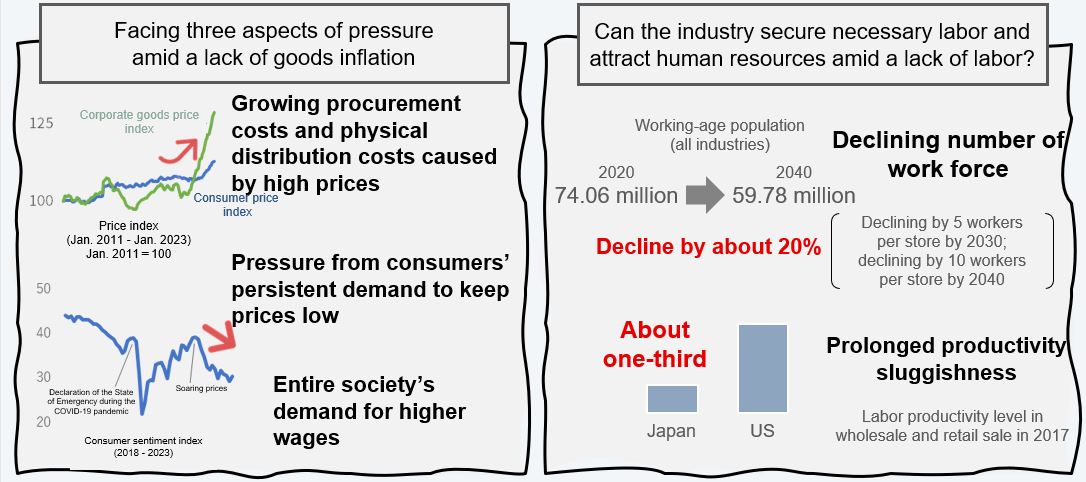

However, the industry is now facing three aspects of pressure, i.e., pressure from growing costs, e.g., procurement, energy and logistics costs; pressure from consumers’ persistent demand to keep prices low; and pressure from the entire society’s demand for higher wages. This places more pressure on the profit structure of the industry. Moreover, a labor shortage, a mid-to-long term issue, has been becoming apparent in the industry.

Aiming to encourage the industry to sustain its distribution function as an essential infrastructure for people’s day-to-day lives, METI launched a “Study Group on Ideal Approaches to the Distribution Industry Facing High Prices,” bringing together experts in such related fields as macroeconomics, distribution and logistics, a variety of personnel representing the distribution industry, consumers, the press and administrative offices, and other stakeholders, and it held discussions on future directions of efforts required for the distribution industry.

In addition, METI considers it important to encourage the distribution industry to introduce DX through establishing partnerships with such businesses as startups holding excellent digital technologies. Taking this opportunity, METI held a SUPER-DX Contest, as an event to cultivate such promising IT companies in the industry and promote business matching. The final review of its applicants was conducted by the members of the study group. The winners were recognized and made presentations at several occasions such as industry events.

2. Highlights of the report

The current cost-push inflation and the decline in the domestic labor population commonly represent resource constraints on the supply side facing the distribution industry. To overcome these challenges, it is indispensable for the industry to fundamentally redefine its conventional approach to resources, reform the existing business practices to new ones, not an extension of the existing ones, and improve its productivity through this reform.

The distribution and logistics industries have been dependent on on-site labor and responsiveness in the framework of labor-intensive and low-wage structures, which lie behind the provision of quality services. As a result, the industries’ awareness of efforts for fully utilizing the value of their resources is weak, as some experts point out.

To address this situation, the study group focused on the basic idea of “breaking away from easy dependence on workers, investing in resources and making use of them to the maximum extent possible” and it identified the following future directions as those that the industries should aim at.

- Reform resources: DX for further streamlining business and improving value added

- Share resources: Providing more efficient supply chains (vertical and horizontal collaboration and integration)

- Utilize resources for value creation: Presenting diverse services based on the demand of consumers and communities

The report highlights ROIC (return on invested capital), as a management index for reference, aiming to shift the management biased to the viewpoint from the so-called PL (profit and loss statement) of sales and other elements to the management being conscious of the balance sheet to improve "earning power" over the med-to-long term by incorporating a perspective of resources.

The report also concludes that, in considering resource strategies, it is important to identify competition areas and collaboration areas, and that particularly in the latter, the government should support the industries in establishing standards and platforms so as to allow broader cooperation among businesses in the private sector.

3. Information on the report

- Visit

this website (in Japanese) for information on the “Study Group on Ideal Approaches to the Distribution Industry Facing High Prices.”

this website (in Japanese) for information on the “Study Group on Ideal Approaches to the Distribution Industry Facing High Prices.”

- Report compiled by the Study Group on Ideal Approaches to the Distribution Industry Facing High Prices (in Japanese)

- Appendix to the report:

“METI’s Supporting Scheme to Encourage the Distribution Industry to Introduce DX ” (in Japanese)(PDF:502KB)

“METI’s Supporting Scheme to Encourage the Distribution Industry to Introduce DX ” (in Japanese)(PDF:502KB)

4. FY2022 SUPER-DX Contest

METI held a SUPER-DX Contest as an event to accelerate the introduction of DX into supermarkets, convenience stores and other retail stores. METI hereby introduces 22 leading businesses* as solutions to overcome challenges that the distribution industry faces, such as digital platforms with accumulated big data of smartphone location data, an optimization system for production volume adjustment, and discount rates based on analysis of data on sales and disposal of products.

*Note: These businesses are applicants that passed the primary screening.

Related Materials

Division in Charge

Consumer Affairs, Distribution and Retail Industry Division, Commerce and Service Industry Policy Group