- Home

- News Releases

- Back Issues

- April FY2023

- 2022 Ratio of Cashless Payment Among the Total Amount Paid by Consumers Calculated

2022 Ratio of Cashless Payment Among the Total Amount Paid by Consumers Calculated

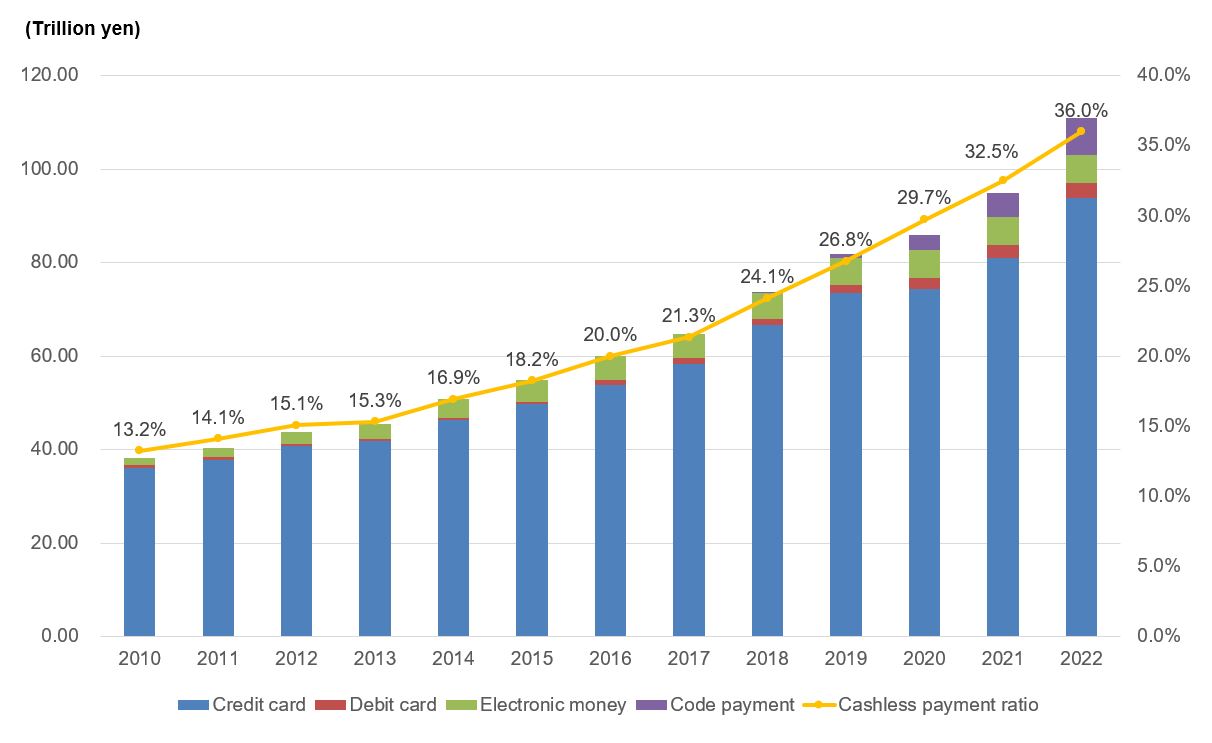

- The ratio increased to 36.0% and the total payment amount expanded to over 100 trillion yen for the first time -

April 6, 2023

Upholding the goal of increasing the ratio of cashless payment among the total amount paid by consumers (hereinafter referred to as the “cashless payment ratio”) to around 40% by 2025, the Ministry of Economy, Trade and Industry (METI) has been advancing efforts for promoting such payment. As part of the efforts to achieve this goal, METI has been calculating and publicizing cashless payment ratios on a regular basis. The cashless payment ratio in 2022 was 36.0%.

1. Overview of the calculation results

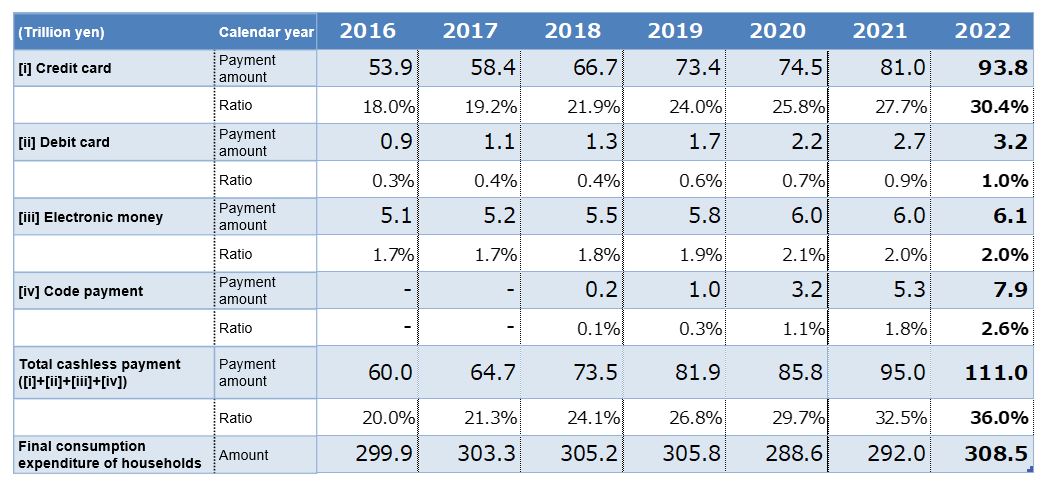

In 2022, the cashless payment ratio steadily increased to 36.0% (111 trillion yen). Looking at the breakdown of the ratio by payment means, credit cards accounted for 30.4% (93.8 trillion yen), debit cards for 1.0% (3.2 trillion yen), electronic money for 2.0% (6.1 trillion yen), and code payment for 2.6% (7.9 trillion yen).

Changes in the cashless payment amount and cashless payment ratios in Japan (until 2022)

Changes in the breakdown of the cashless payment amount and that of cashless payment ratios by payment means

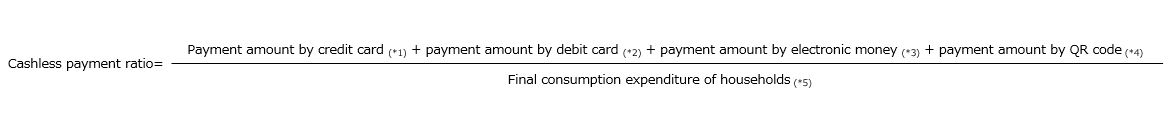

2. Calculation method

After the release of the previous-year results from certain data sources, METI, on the basis of the calendar year data, has been calculating and publicizing the cashless payment ratio every year using the following formula in order to show an indicator for ascertaining the progress in dissemination of cashless payment.

Data sources:

*1: Japan Consumer Credit Association (JCA)

Note: In or before 2012, METI used estimates based on the results of questionnaire surveys that JCA conducted targeting credit card companies as JCA members, while in and after 2013, METI has been using actual values registered in designated credit information organizations.

*2: Japan Electronic Payment Promotion Organization (until 2015); and “Payment and Settlement Systems” and “Payment and Settlement Statistics” released by the Bank of Japan (in and after 2016)

*3: “Payment and Settlement Statistics” released by the Bank of Japan

*4: “Trends in Use of Code Payment” released by Payments Japan Association

*5: “National Accounts of Japan” (nominal values) released by the Cabinet Office

Related Material

Division in Charge

Cashless Payment Promotion Office, Commerce and Service Industry Policy Group