- Home

- News Releases

- Back Issues

- April FY2023

- METI‘s first attempt to compile for Japanese Companies “Case Studies Relating to the Use of Inbound M&A Transactions”

METI‘s first attempt to compile for Japanese Companies “Case Studies Relating to the Use of Inbound M&A Transactions”

April 19, 2023

*On August 8, 2023, "6. Publication of materials" was updated due to a typographical error on page 13, and the list of "3. Case Studies provided in the research" was also accordingly corrected.

The Ministry of Economy, Trade and Industry (METI) has compiled a research of “Case Studies Relating to the use of Inbound M&A Transactions - Case Studies of Japanese Companies that Leveraged Foreign Capitals for Corporate Reforms, Management Enhancement and Dramatic Growth”. This is a reference material for Japanese companies that may consider the use of inbound M&A transactions (namely, M&A transactions of Japanese companies implemented by foreign companies or foreign private equity (PE) funds) as one of the options to solve management issues and accelerate the company’s growth.

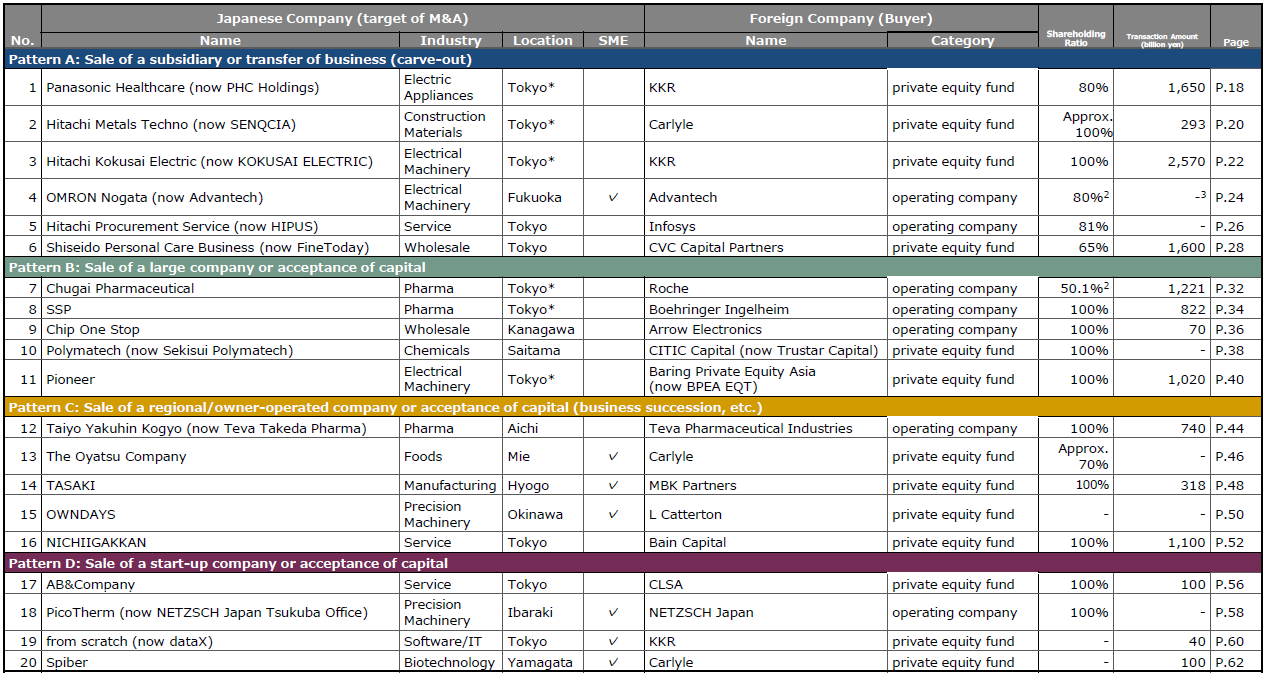

This research contains 20 case studies of Japanese companies that successfully conducted inbound M&A transactions by effectively utilizing foreign capitals. It also illustrates challenges that these companies previously faced prior to such transactions, cautions for inbound M&A transactions and benefits thereof, among other points.

METI has prepared this research that features inbound M&A case studies for the first time.

Moreover, METI will hold an online briefing to explain the research on May 17 (Wed.), 2023.

1. Background

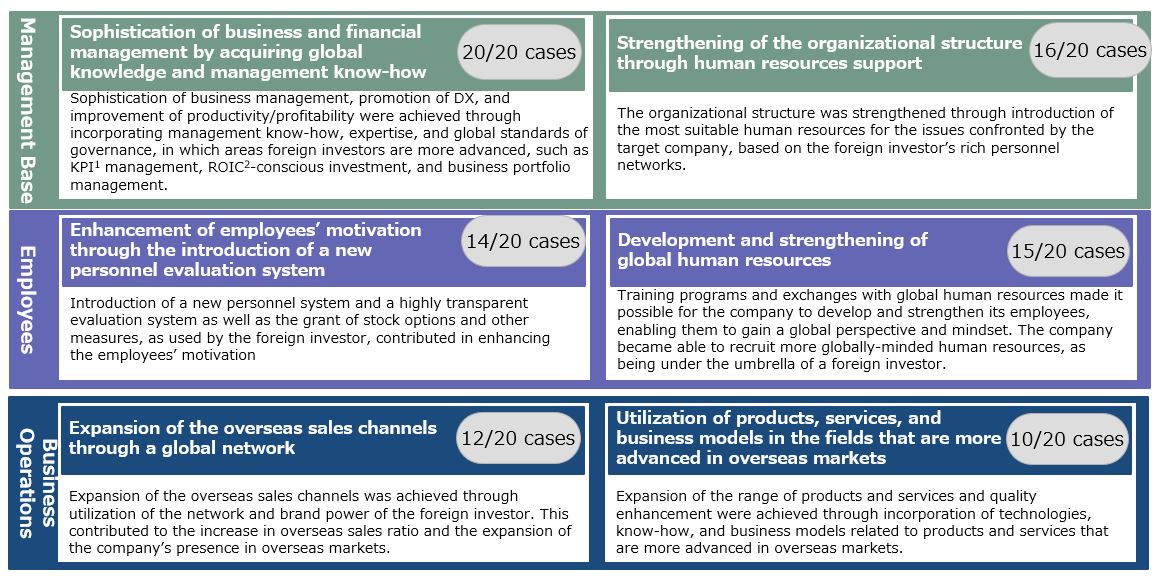

In recent years, the total number and value of inbound M&A transactions (which are one of business approaches in utilizing foreign capitals) has been growing in Japan, and some Japanese companies have achieved sophistication of business management, strengthening and development of human resources, expansion of overseas sales channels, and other growth by utilizing global networks, know-hows and other benefits that foreign investments can offer.

Acknowledging this trend, METI established a Study Group for Issues Relating to Inbound M&A Transactions and Case Studies in September 2022 for the purpose of discussing the effects and significance of inbound M&A transactions. Following this, the study group focused on inbound M&A transactions conducted by overseas companies and overseas PE funds as well as business management and business expansion after the transactions, and then analyzed the challenges that successful Japanese companies faced in advancing inbound M&A transactions, cautions for inbound M&A transactions, benefits thereof, among other points.

Based on the results of the discussions and in light of considerations for economic security and other perspectives, METI has compiled a research of “Case Studies relating to the use of Inbound M&A Transactions - Case Studies of Japanese Companies that Leveraged Foreign Capitals for Corporate Reforms, Management Enhancement and Dramatic Growth” This is a reference material for Japanese companies which may consider using inbound M&A transactions as one of the options to solve management issues and accelerate the company’s growth.

2. Outline of the Research

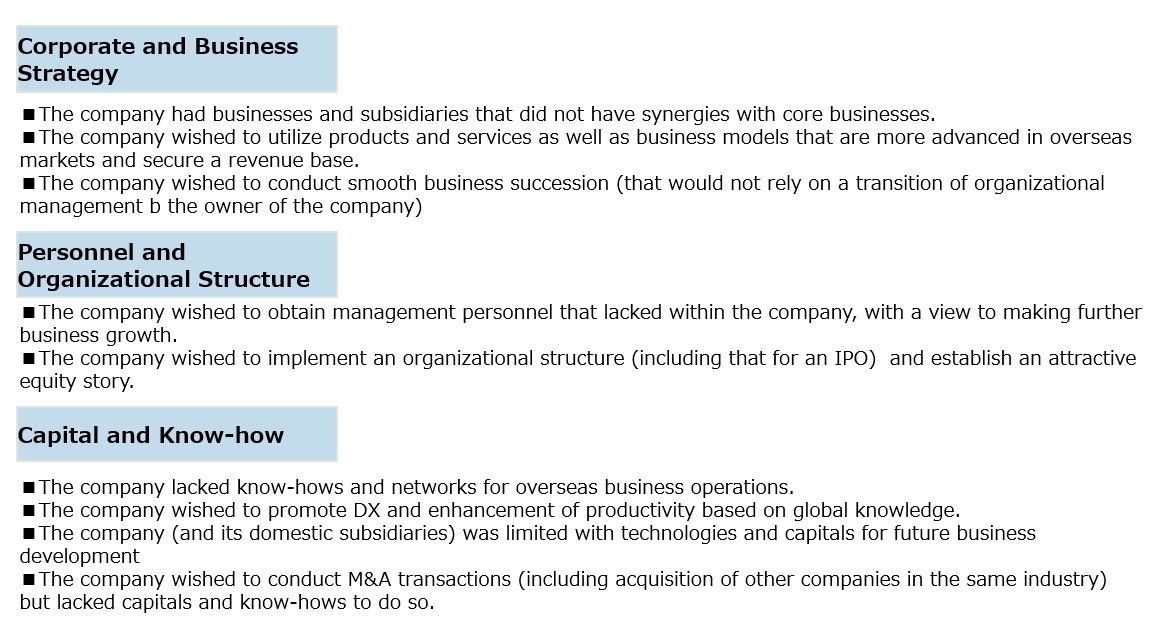

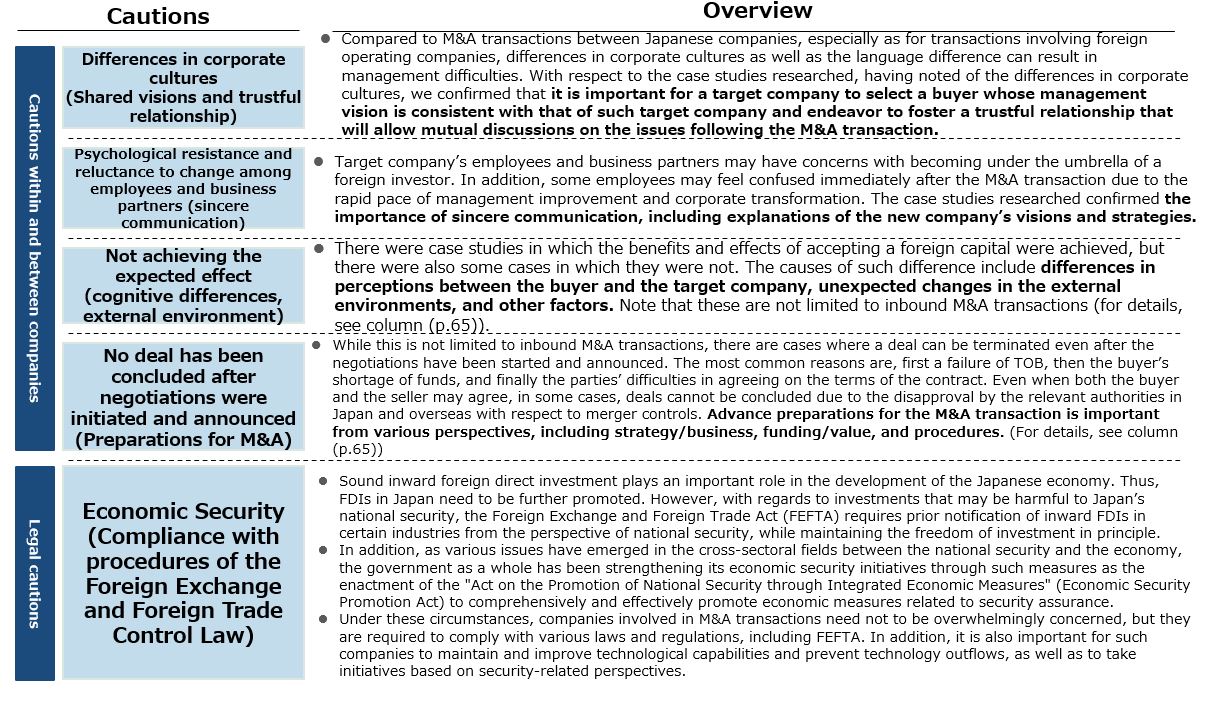

This research contains 20 selected case studies of Japanese companies that successfully solved management issues or achieved corporate growth by effectively utilizing foreign capitals. It also illustrates challenges that these companies previously faced prior to the transactions, cautions for inbound M&A transactions, including economic security and other perspectives, the benefits thereof, among other points.

3. Case Studies provided in the research

The research introduces case studies of not only large Japanese companies, but also regional medium-sized companies and SMEs that achieved business succession, as well as startups. It classifies these companies by scale, business transaction method and other considerations into four categories, which enable the readers to easily understand.

4. Features of the research

- METI has prepared this research that solely features inbound M&A Case Studies for the first time.

- METI selected case studies based on a well-balanced consideration of industries and regions of target companies, nationalities of buyers and other elements.

- The research provides the real names of the successful companies for all case studies which was supported based on the cooperation received from the companies.

- This research presents indexes of challenges that companies may have faced and benefits of the M&A transactions, enabling the readers to easily retrieve case studies.

- This research efforts that successful companies took to solve challenges and their progresses towards growth, together with the direct voices/opinions of their employees. It is well-designed as a practical collection of case studies introducing not only the positive aspects of inbound M&A transactions but also the specific challenges thereof.

5. An Online Briefing to explain the research (May 17 (Wed.), 2023)

METI and the Research Institute of Economy, Trade and Industry (RIETI) will jointly hold an online briefing to explain this research, including explanations on the outline of the research, lecture relating to inbound M&A transactions and explanations on the case studies by foreign PE funds.

If you wish to know the details of this session and how to attend, visit the RIETI website below.

- Date and time: May 17 (Wed.), 2023; from 12:15 to 13:30

- Format of the briefing: Online (live broadcasting; participation fee: free of charge)

- For information on how to attend and the details of the session, visit

here

here

6. Publication of materials

- Case Studies relating to the use of Inbound M&A Transactions(PDF:2,518KB)

*English version was updated on August 8, 2023.

*English version was updated on August 8, 2023.

Links to related information

- Case Studies relating to the use of Inbound M&A Transactions (webpage exclusively for this research) (in Japanese)

- Study Group for Issues Relating to Inbound M&A Transactions and Case Studies (in Japanese)