- Home

- News Releases

- Back Issues

- January FY2025

- METI Compiles Report on Amendment of the Companies Act Based on Study Group on Corporate Governance toward the Enhancement of Earning Power

METI Compiles Report on Amendment of the Companies Act Based on Study Group on Corporate Governance toward the Enhancement of Earning Power

January 17, 2025

*In the attached figure in the release Future Direction of Amending the Companies Act to Enhance Companies’ Investment for Growth, some words have been corrected for accuracy on April 3, 2025.

The Ministry of Economy, Trade and Industry (METI) took into consideration the discussions in the Study Group on Corporate Governance toward the Enhancement of Earning Power and has compiled a Report on the Amendment of the Companies Act.

1. Background

In September 2024, METI launched a Study Group on Corporate Governance toward the Enhancement of Earning Power to hold discussions on approaches that Japanese companies should take in advancing corporate governance reform to enhance their earning power and the future direction of amending the Companies Act (Chair: Mr. Kanda Hideki, Emeritus Professor, the University of Tokyo).

The study group discussed how the corporate law system should be, which is the foundation of business activities, to encourage companies to enhance their earning power even amid the growing complexity of the external environment surrounding them and the further intensification of global competition.

METI took into consideration the discussions in the study group and has compiled a Report on the Amendment of the Companies Act regarding ideal approaches to the amendment of the Companies Act.

2. Overview of the report

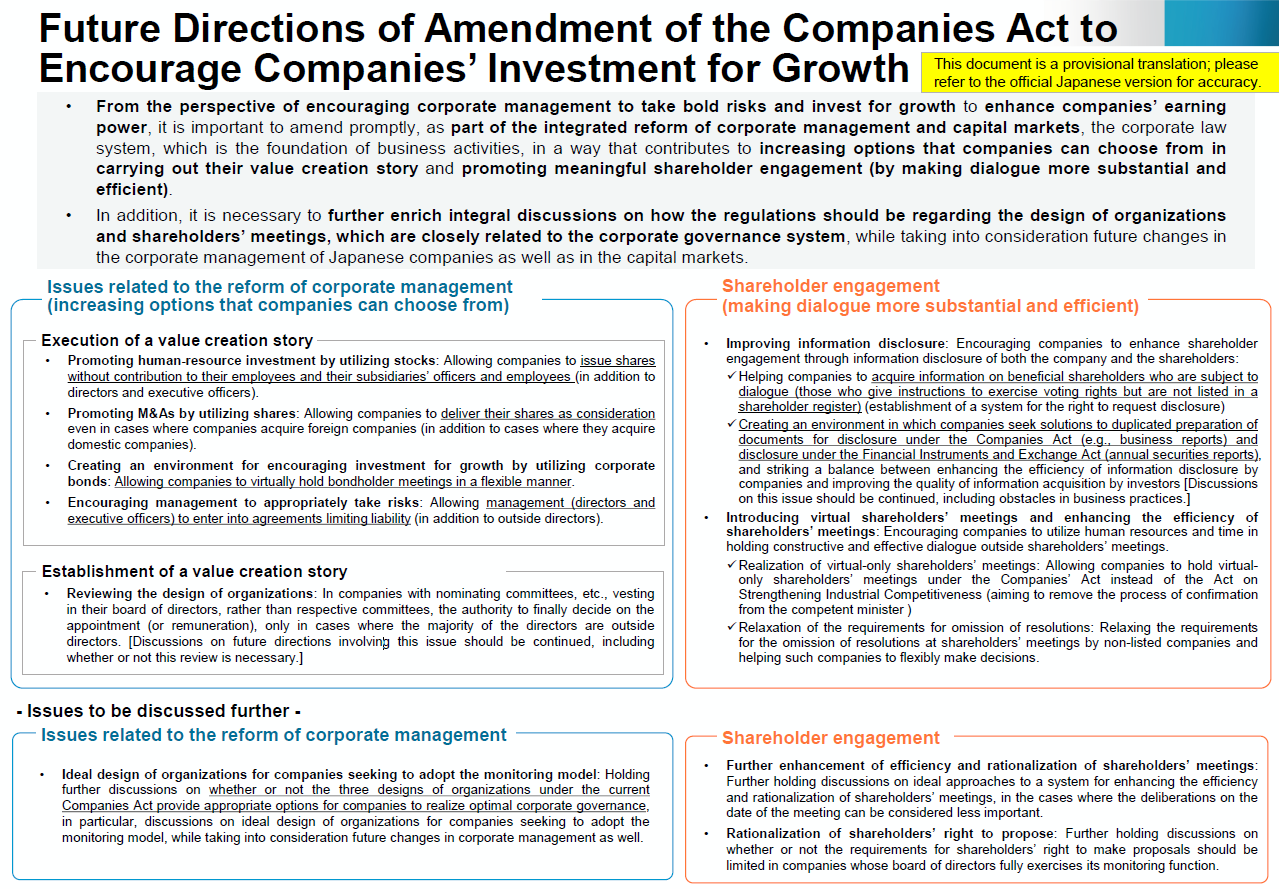

From the perspective of encouraging corporate management to take bold risks and investment for growth to enhance companies’ earning power, the report suggests that it is important to amend promptly, as part of the integrated reform of corporate management and capital markets, the corporate law system, the foundation of business activities, in a way that contributes to increasing options that companies can choose from in carrying out their value creation story and promoting meaningful shareholder engagement (by making dialogue more substantial and efficient).

It also points out that it is necessary to further enrich integral discussions on how the regulations should be regarding the design of organizations and shareholders' meetings, which are closely related to the corporate governance system, while taking into consideration future changes in the corporate management of Japanese companies as well as in the capital markets.

3. The report (in Japanese)

- Study Group on Corporate Governance toward the Enhancement of Earning Power: Report on the Amendment of the Companies Act(PDF:675KB)

- Study Group on Corporate Governance toward the Enhancement of Earning Power: Report on the Amendment of the Companies Act (Summary)(PDF:1,772KB)

Related Links (in Japanese)

- Study Group on Corporate Governance toward the Enhancement of Earning Power (METI)

- A variety of study groups on corporate governance (METI)

Division in Charge

Corporate System Division, Economic and Industrial Policy Bureau