- Home

- News Releases

- Back Issues

- May FY2025

- Release of Interim Report of the Subcommittee on Value Creation Management

Release of Interim Report of the Subcommittee on Value Creation Management

May 30, 2025

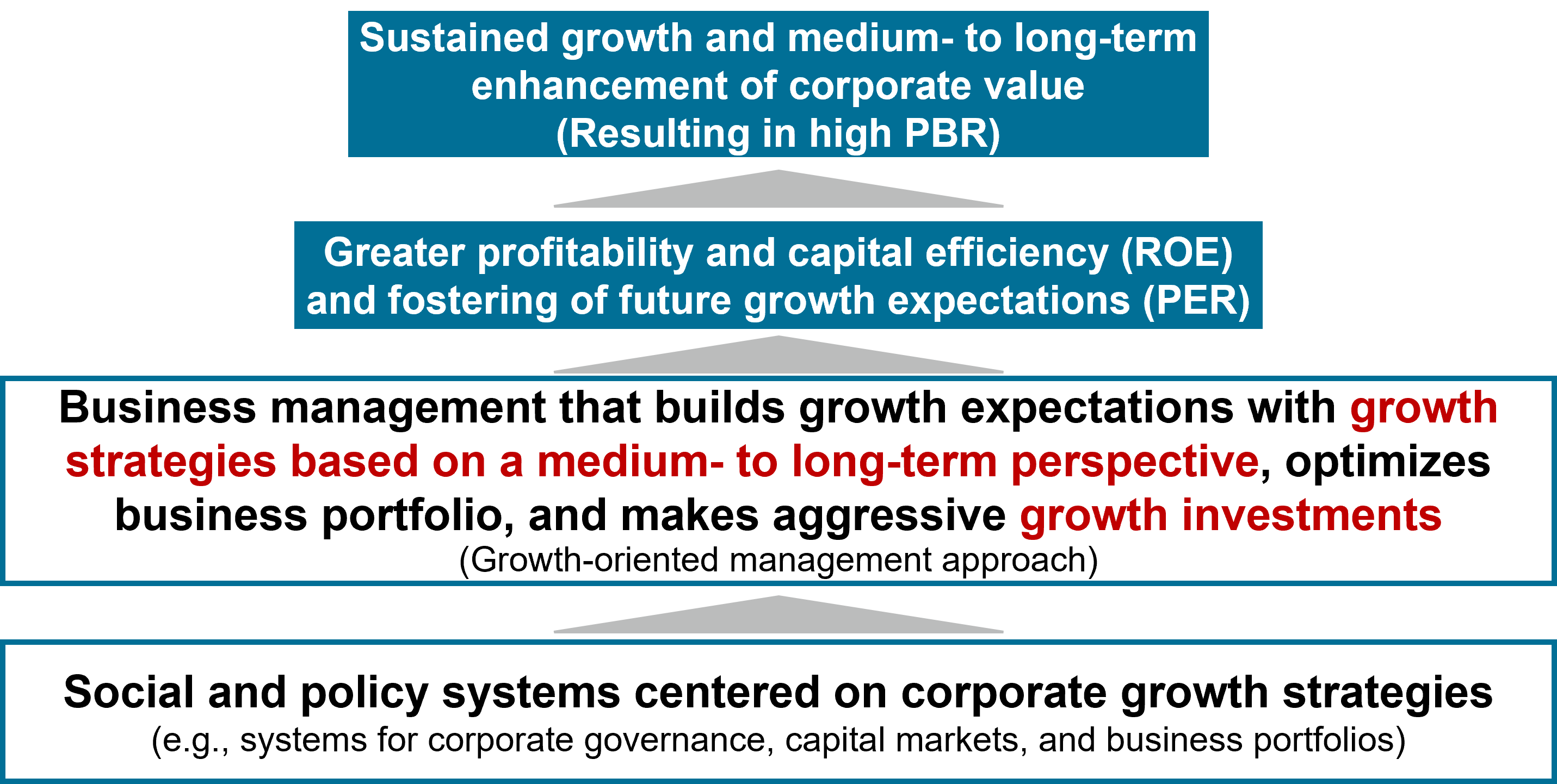

The Ministry of Economy, Trade and Industry (METI) established the Subcommittee on Value Creation Management under the Committee on New Direction of Economic and Industrial Policies of the Industrial Structure Council to discuss the social system challenges that hinder companies from developing and implementing growth strategies, as well as the direction of the consideration of the policy to address them, with the aim of building social and policy systems centered on corporate growth strategies.

Today, METI released a compilation of the Subcommittee’s discussions to date in the form of an interim report.

1. Background and Awareness of the Challenges

As Japan makes steady progress toward overcoming deflation, and as the cost of raw materials and labor rises sharply both in Japan and abroad, companies can no longer expect to achieve sustained earnings growth through cost-cutting management alone. Amid intensified global investment competition to gain the initiative in growth areas with high uncertainty, such as green transformation (GX) and digital transformation (DX), it has become vital for companies to formulate and implement growth strategies that cultivate new markets. Under these circumstances, some argue that, while they increase sales, profits, and shareholder returns steadily, listed companies in Japan have not managed to fully embark on bold growth investments that lead to medium- to long-term earnings growth, such as in human resources, R&D, and equipment.

Aware that social system challenges may also play a role in hindering companies from taking risks to implement growth strategies, the Subcommittee discussed such challenges and the direction of the consideration of the policy to address them, with the aim of building social and policy systems centered on corporate growth strategies. ”By doing so, the aim is to enable companies to adopt a growth-oriented management approach, in which they take risks and strive for sustainable growth, or in other words, build growth expectations with a growth strategy based on a medium- to long-term perspective, optimizing their business portfolio, and making aggressive growth investments.

Note: The Subcommittee discussed the challenges with Japanese listed companies in mind.

2. Overview

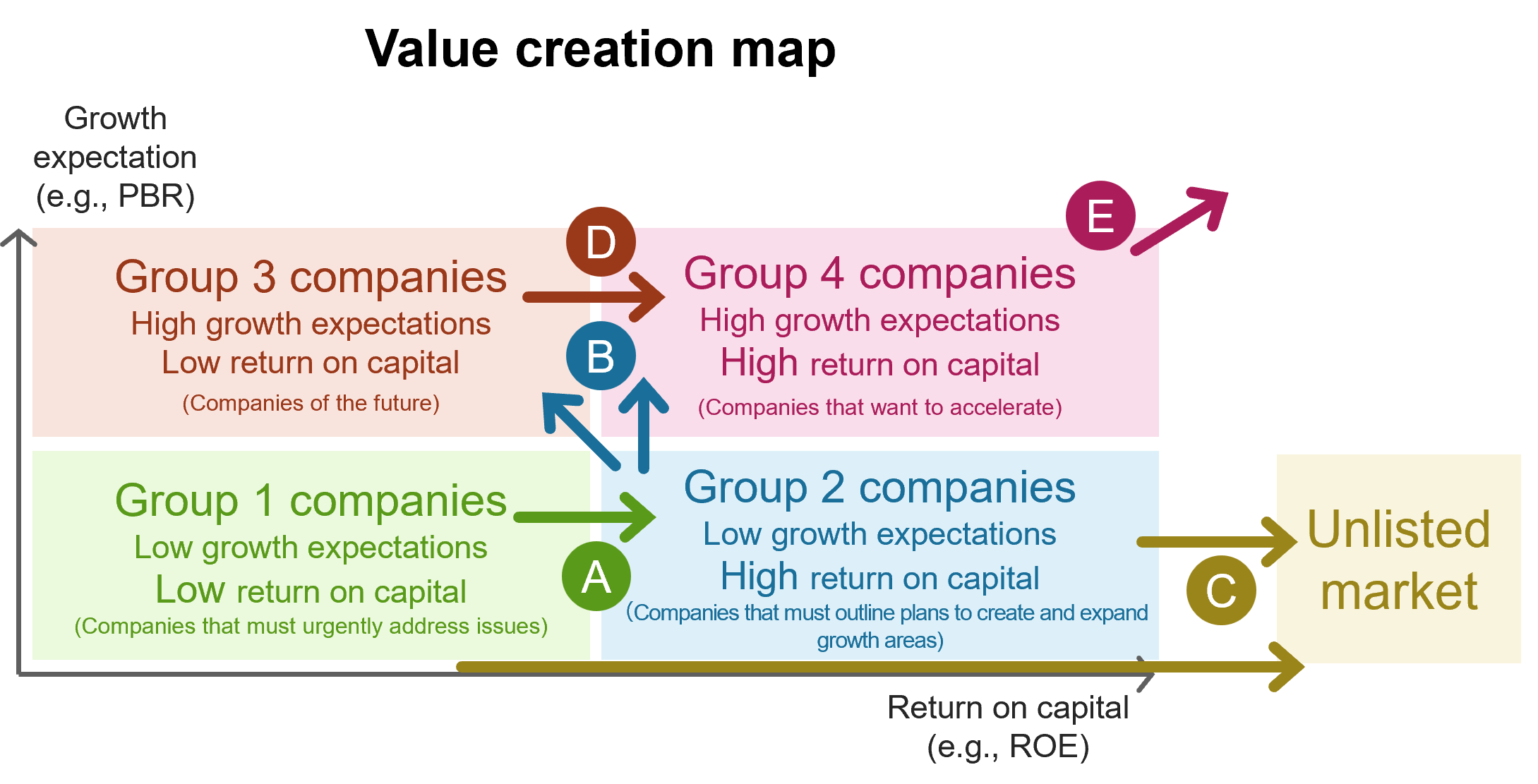

This Interim Report organizes the direction of the consideration of the policy necessary to realize social systems centered on corporate growth strategies and categorizes all listed companies into corporate group quadrants (1) through (4) based on return on capital (e.g., ROE) and growth expectations (e.g., PBR). It then uses a Value Creation Map to summarize the effective corporate actions that we believe are of high priority when companies seek to transition to a quadrant of higher return on capital and growth expectations and the social system challenges that hinder the implementation of these actions.

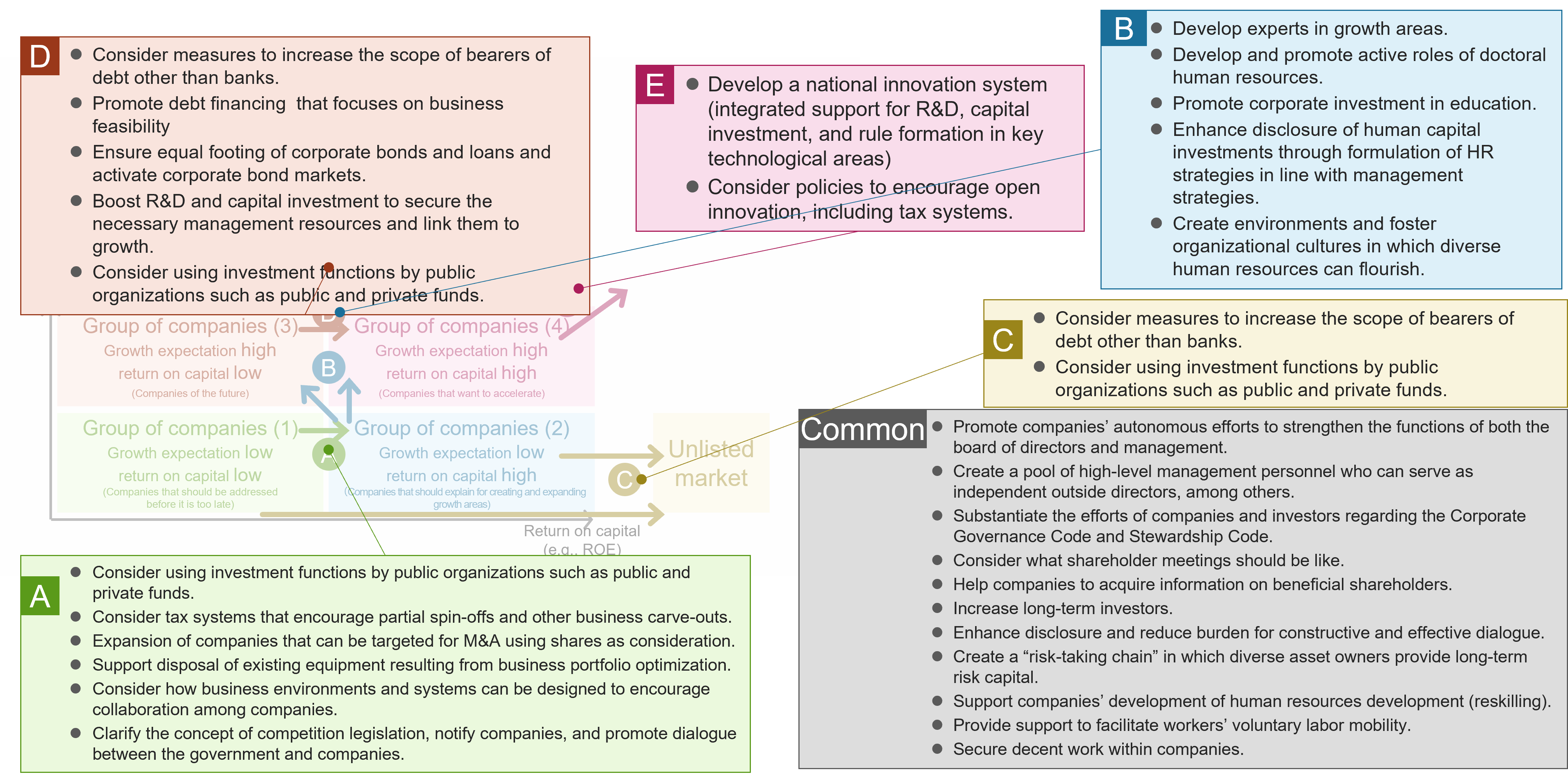

For instance, for a company to transition from Group 1 (low growth expectations and low return on capital) to Group 2 (low growth expectations but high return on capital), high-priority actions would include structural reforms, such as strengthening the profitability of existing businesses and reclassifying businesses and assets based on core competencies. The challenges in this case include diversifying business restructuring methods and speeding up inter-company collaboration. For a company in Group 3 (high growth expectations but low return on capital) to shift up to Group 4 (high growth expectations and high return on capital), or for a company in Group 4 to achieve further growth, it will be effective to continue or accelerate growth investments and prioritize shareholder return. The challenges for these cases include fundraising for large-scale, high-risk investments, among others, as well as research and development in collaboration with universities and start-ups.

As challenges common to all routes, the report also covers the ensuring of effective corporate governance, shareholder returns, shareholder meetings, the exercise of voting rights, disclosure to foster relationships of joint value creation between companies and investors, and the diversification of asset owners that provide long-term risk capital.

Value Creation Map

Lastly, the report outlines the direction of the consideration of the policy to solve social system challenges that hinder the implementation of these actions. Based on this outline, METI will materialize, implement, and verify the necessary measures to build a social system centered on corporate growth strategies, including the development of a domestic investment environment.

Direction of Policy Consideration

(Source) Created by METI based on the interim report

Related Links (in Japanese)

Division in Charge

Industry Creation Policy Division, Economic and Industrial Policy Bureau