- Home

- News Releases

- Back Issues

- April FY2024

- Case Studies Relating to Collaborations and Joint Ventures between Japanese and Foreign Companies in Japan companies Compiled

Case Studies Relating to Collaborations and Joint Ventures between Japanese and Foreign Companies in Japan companies Compiled

- Tips for enhancing management power through cooperation with foreign companies to achieve further growth -

April 24, 2024

The number of collaborations and joint ventures between Japanese and foreign companies in Japan has increased by approximately three time over the past ten years, and the transaction amount thereof has increased by approximately five times over the past ten years. The number of such transactions is at its highest level in the past 20 years.

In light of this, the Ministry of Economy, Trade and Industry(METI)has prepared a research on "Case Studies relating to Collaborations and Joint Ventures between Japanese and Foreign Companies in Japan" as a reference upon the use of foreign capitals as one of the options to solve management issues and accelerate growth.

11 cases have been selected, which achieved innovations and overseas expansions as exemplified and responded to their corporate management issues.

This is the first time that METI has compiled and published a comprehensive research of case studies on collaborations and joint ventures between Japanese and foreign companies with their actual company names, covering M&As, minority investments, and joint investments.

The case studies contain cases that elucidate the significance of collaborations and joint ventures with foreign companies, approaches to making contacts with foreign companies, difficulties and devised efforts, and future visions, with an aim the case studies reflect more practical and implementable contents. METI wishes that a wide variety type of Japanese companies will make use of this case studies as a reference that will help these companies to choose collaborations and joint ventures with foreign companies as one of the options to solve management issues and accelerate growth.

1. Background

The number of collaborations and joint ventures between Japanese and foreign companies in Japan has increased by approximately three time over the past ten years, and the transaction amount thereof has increased approximately five times over the past ten years. The number of such transactions is at its highest level in the past 20 years.

Japanese companies that engage in collaborations and joint ventures with foreign companies are utilizing foreign companies’ global networks and know-hows, including but not limited to, to expand overseas sales channels, improve management such as the promotion of digital transformation (DX) and human capital management, and create innovations.

In recent years, the Japanese economy has been experiencing signs of a turning point, as seen in the highest volume of capital investments in the private sector and the highest wage increase in 30 years. In addition, the Japanese market is attracting more attention from the rest of the world based on the recognition of its geopolitical stability. METI considers it important for Japanese companies to take this opportunity to proactively accept foreign investments and strengthen their management power, which is a critical key to achieving sustainable corporate growth.

For the regional economy, METI also expects that this approach will contribute not only to creating new industries and employment that support regional areas but also to vitalizing such areas through enhanced supply chains.

Meanwhile, as some point out, Japanese companies are often psychologically resistant to foreign capital and are delayed in building internal management structure, and Japanese companies lag behind of their competitor foreign companies in other countries with respect to collaborations and joint ventures with foreign companies.

For this reason, METI has prepared research on "Case Studies relating to Collaborations and Joint Ventures between Japanese and Foreign Companies in Japan" as a reference upon the use of foreign capitals as one of the options to solve management issues and accelerate growth.

2. Outline of the Research

The Case Studies present 11 carefully selected cases of Japanese companies that have succeeded in effectively utilizing overseas capital to solve management issues and achieve corporate growth, including their acceptance of joint investments with foreign companies and minority investments from foreign companies. To provide the most practical contents possible, the case studies also outline the background, challenges, history, and purposes of Japanese companies’ collaborations and joint ventures with foreign companies as well as the process of collaboration(consolidation) and the results achieved after accepting such investments. It also presents Japanese companies’ efforts made to solve challenges, key points of success, and devised efforts in advancing collaborations and joint ventures, in a well-organized manner.

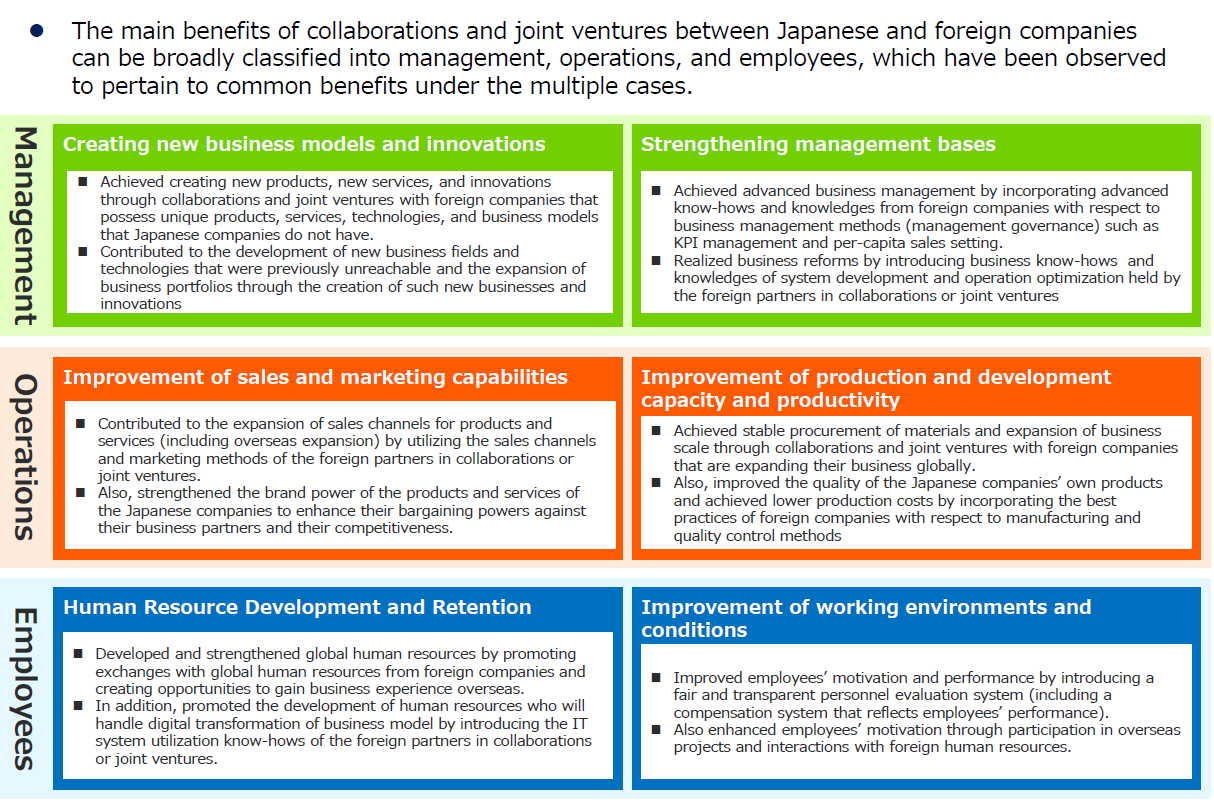

Major benefits brought about by collaborations and joint ventures

3. Case Studies provided in the research

The Case Studies explains cases of not only large companies but also regional SMEs and startups.

4. Features of the Research

- The Case Studies Relating to the Use of Inbound M&A Transactions, which METI released in April 2023, mainly features inbound M&A (majority investments), while the scope of the Case Studies has widely subjected to not only collaborations and joint ventures, but also options such as joint investment with foreign companies and acceptance of minority investment from foreign companies, aimed at responding to a wider range of needs for these transactions and making the content for more practical application.

- The Case Studies consist of the cases that METI selected based on the consideration of a balance of industries, regions, and corporate sizes and of nationalities of foreign companies.

- All of these cases are disclosed with their company names.

- It presents indexes that will help companies to retrieve case studies based on the target benefits that they are interested in (e.g., creation of new business models and innovation).

- It presents efforts that successful companies made, ranging from the background to their utilization of foreign capital, to the processes that led to business growth after collaborations and joint ventures, together with the opinions of stakeholders. It is designed as a practical collection, referring to not only the positive aspects of collaborations and joint ventures with foreign companies, but also specific difficulties and devised efforts.

5. An Online Briefing to explain the research (May 27, 2024)

METI and the Research Institute of Economy, Trade and Industry (RIETI) will jointly hold an online briefing to explain the Case Studies, including explanations on the outline of the collection, lectures on collaborations and joint ventures, and an introduction of Case Studies of successful companies shown in the collection.

If you wish to learn the details of the briefing and how to view it, visit the RIETI website below.

- Date and time: Monday, May 27, 2024; from 12:15 to 13:15 (tentative)

- Format of the briefing: Online (live broadcast; free of charge)

- For information on how to view the briefing and the related details, visit this link.

Related Material

Related Links

*The English version was posted on the above web page on July 19, 2024.

Division in Charge

Trade and Investment Facilitation Division, Trade and Economic Cooperation Bureau