- Home

- News Releases

- Back Issues

- June FY2025

- Formulation of the Guidebook for Leveraging Foreign Capital to Enhance Corporate Value

Formulation of the Guidebook for Leveraging Foreign Capital to Enhance Corporate Value

June 25, 2025

The Ministry of Economy, Trade and Industry (METI) has compiled a Guidebook for Leveraging Foreign Capital to Enhance Corporate Value (hereinafter the “Guidebook”) to enable Japanese companies to more specifically consider leveraging foreign capital as one of the options to enhance their corporate value.

This Guidebook provides the following practical content:

- “Basic Knowledge” that should be gained before considering a specific project utilizing foreign capital, including an overview of leveraging foreign capital, its benefits, cautionary points, and associated risks.

- Five Basic Actions expected of Japanese corporate executives to increase the benefits of foreign capital utilization and specific case studies of such actions.

The Guidebook is intended to serve as a comprehensive resource for companies considering the use of foreign capital to address management issues and accelerate growth.

1. Background to formulating the Guidebook

With the pace of change in the market environment accelerating in recent years, companies are finding it increasingly difficult to respond quickly to environmental changes by solely using internal resources. In addition, Japan’s share of the global market is declining amid its aging population, low birthrate, and shrinking population. Therefore, it is essential to capture growing overseas markets.

Against this backdrop, it is becoming increasingly important for Japanese companies that are seeking to enhance their corporate value to capture overseas vitality. To this end, the companies should avoid excessive self-reliance and instead promote collaboration and open innovation with overseas entities.

As a form of collaboration, accepting investment from foreign companies with a high level of management expertise and global networks (leveraging foreign capital) is also one of the options. However, Japanese companies tend to maintain a psychological hurdle to consider obtaining foreign capital, which keeps them behind their overseas competitors in terms of leveraging foreign capital.

With more projects by foreign companies interested in investing in Japanese companies, Japanese companies have become aware of the viability of leveraging foreign capital. Meanwhile, it has been pointed out that not sufficient information has been furnished with Japanese companies in respect of leveraging foreign capital, including detailed implementation processes and cautionary points.

In addition, due to intensified global competition to attract foreign capital among countries and capital market reforms aimed at enhancing corporate value in Japan, the significance of considering the use of foreign capital by Japanese companies has been enhanced.

Note: “Leveraging (utilizing) overseas capital” refers to obtaining capital investments from overseas capital sources such as foreign businesses and foreign private equity funds.

2. Overview of the Guidebook

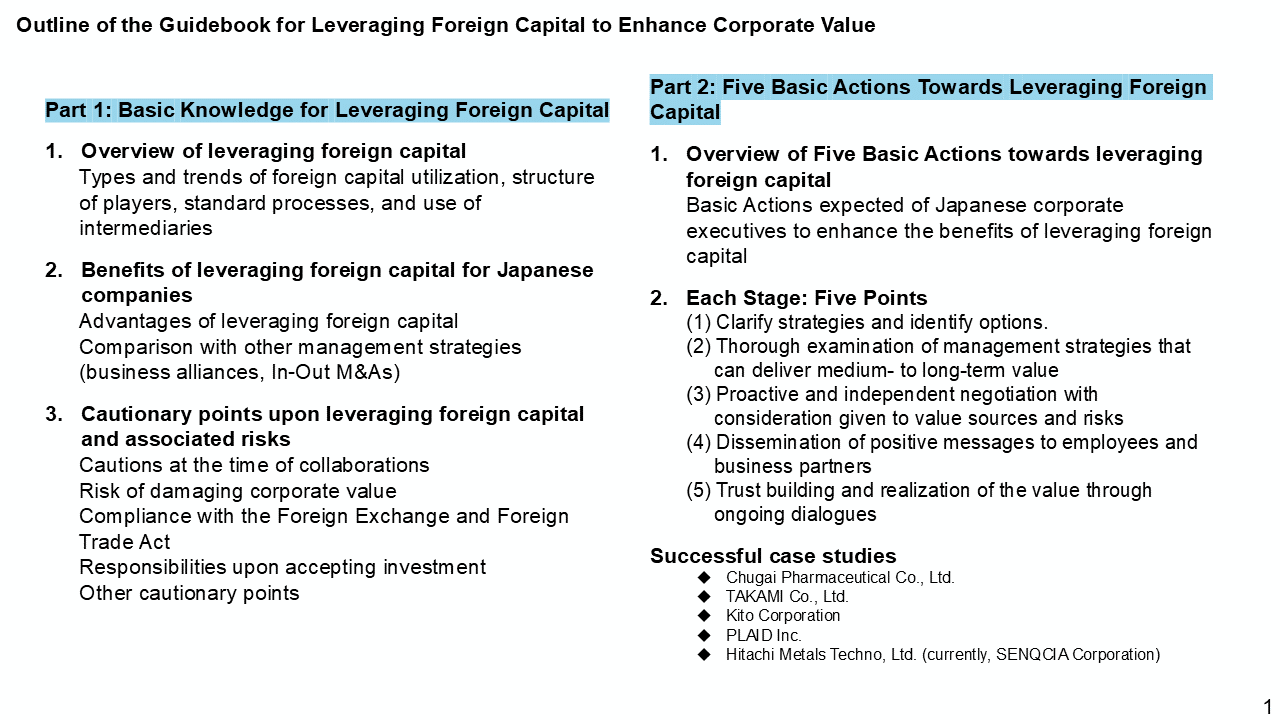

The Guidebook is composed of two parts:

- Part 1 describes Basic Knowledge that Japanese corporate executives need before considering specific projects for leveraging foreign capital; and

- Part 2 outlines the fFve Basic Actions expected of Japanese corporate executives in relation to utilizing foreign capital in order to enhance the effectiveness of foreign capital utilization.

In addition, to provide the most practical content possible, Part 2 contains successfulcase studies of Japanese companies that have implemented some of the Basic Actions. For the names of such Japanese companies featured in the case studies, please refer to the Outline of the Guidebook below.

Outline of the Guidebook

3. Features of the Guidebook

- The Guidebook comprehensively describes the Basic Knowledge required of the Japanese corporate executives who may be contemplating the foreign capital utilization before considering specific projects, including the overview of leveraging foreign capital, its benefits, cautionary pointss and associated risks.

- The standard processes of leveraging foreign capital are divided into five phases, along with the Basic Actions expected to be taken at each phase explained.

- Case studies and names of the companies that have conducted some of the Basic Actions are provided to facilitate the deeper understanding of the actions expected of Japanese corporate executives.

- The Guidebook outlines the roles of different supporting entitiess that could provide appropriate advice at each phase of the process of leveraging foreign capital that may requires various expertise, as well as a checklist upon selecting such advisory services.

- The Guidebook is configured to serve as a reference for a wide range of investment cases, regardless of types of investors (such as foreign companies or foreign private equity funds) or investment ratios (majority or minority investments).

- Although the Guidebook primarily targets executives of a wide range of Japanese companies (large corporations, small and medium-sized enterprises, and start-ups), it has also been prepared to serve as a reference for financial institutions and other entities that act as intermediaries between foreign investors and Japanese companies and/or engage in with supporting or advisory works.

4.Webinar on the Guidebook (July 16, 2025)

METI, jointly with the Research Institute of Economy, Trade and Industry (RIETI), will host an online seminar featuring the brief explanation of the Guidebook, lectures on leveraging foreign capital, and a case study presentation by one of the companies featured in the Guidebook.

For details or to register, please visit the RIETI website at the link below.

- Time and Day:

- 12:15 to 1:15 p.m. (tentative), Wednesday, July 16, 2025

- Format:

- Online (Livestream, free of charge)

- For details or to register:

- click here.

Related materials

- Guidebook for Leveraging Foreign Capital to Enhance Corporate Value (Provisional Translation)(PDF:1,953KB)

*The English version was posted on September 18, 2025.

*The English version was posted on September 18, 2025. - Guidebook for Leveraging Foreign Capital to Enhance Corporate Value (in Japanese)(PDF:3,091KB)

Related links (in Japanese)

- Guidebook for Leveraging Foreign Capital to Enhance Corporate Value (Special page)*The English version was posted on this page on September 18, 2025.

- Study Group on Leveraging Foreign Capital to Enhance Corporate Value

Division in Charge

Investment Facilitation Division, Economic and Industrial Policy Bureau